Instruction for self-employed person

How to register as a self-employed person in the Federal Tax Service through the application “My taxes”?

My taxes is an official application of the Federal Tax Service of Russia for taxpayers who pay taxes on professional services. It helps to register and work on preferential special terms, which is also called the tax for the self-employed persons. The application provides all the interaction between self-employed persons and tax authorities, without visiting personally the inspectorate body. It replaces a cash desk and reports.

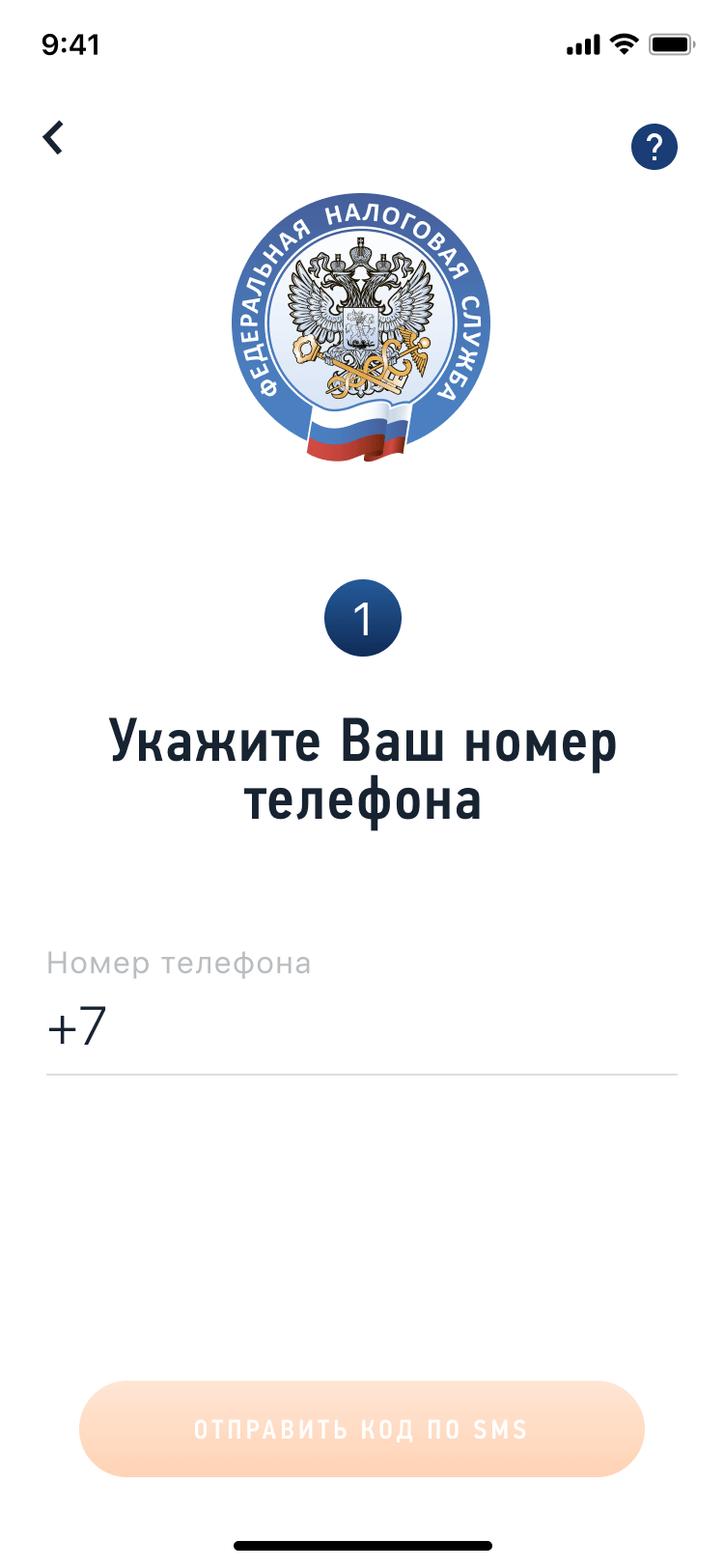

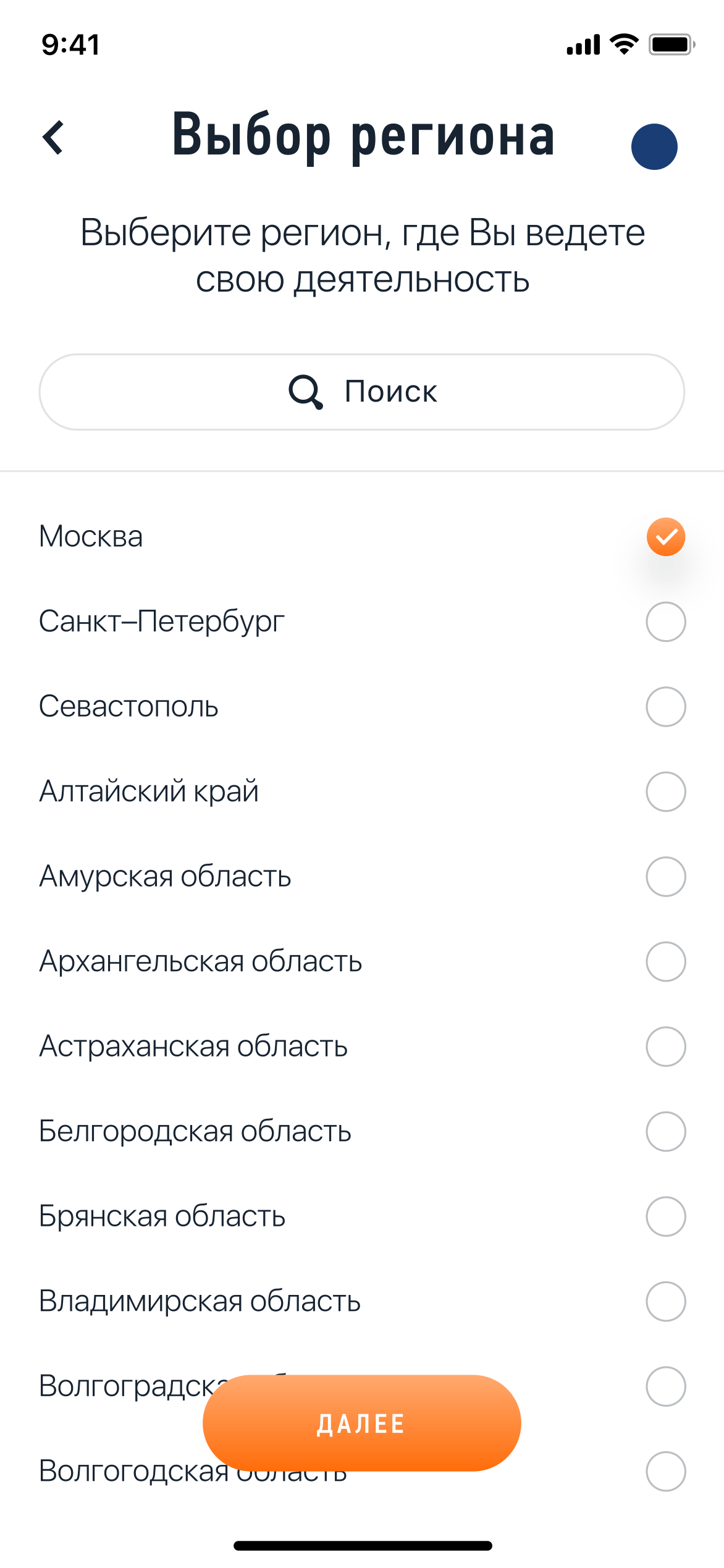

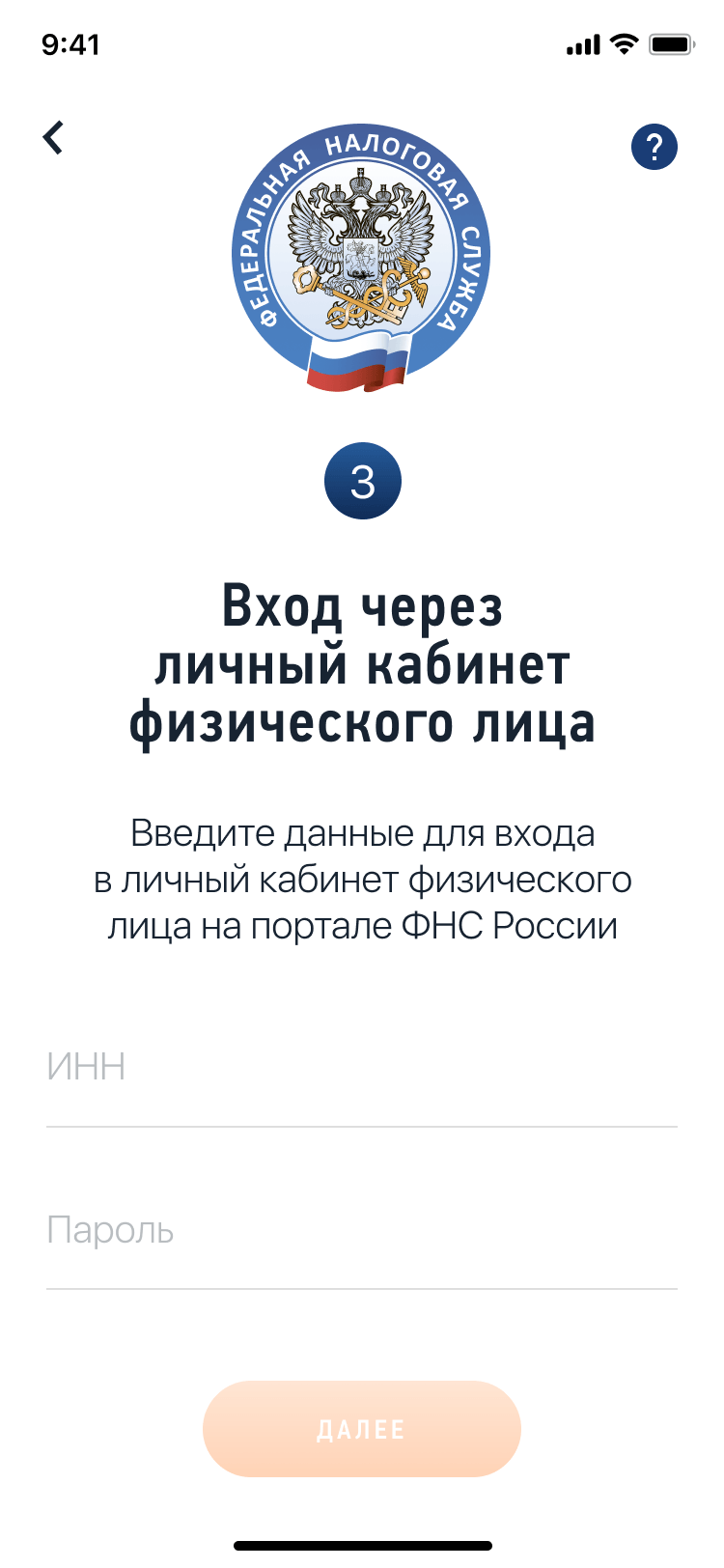

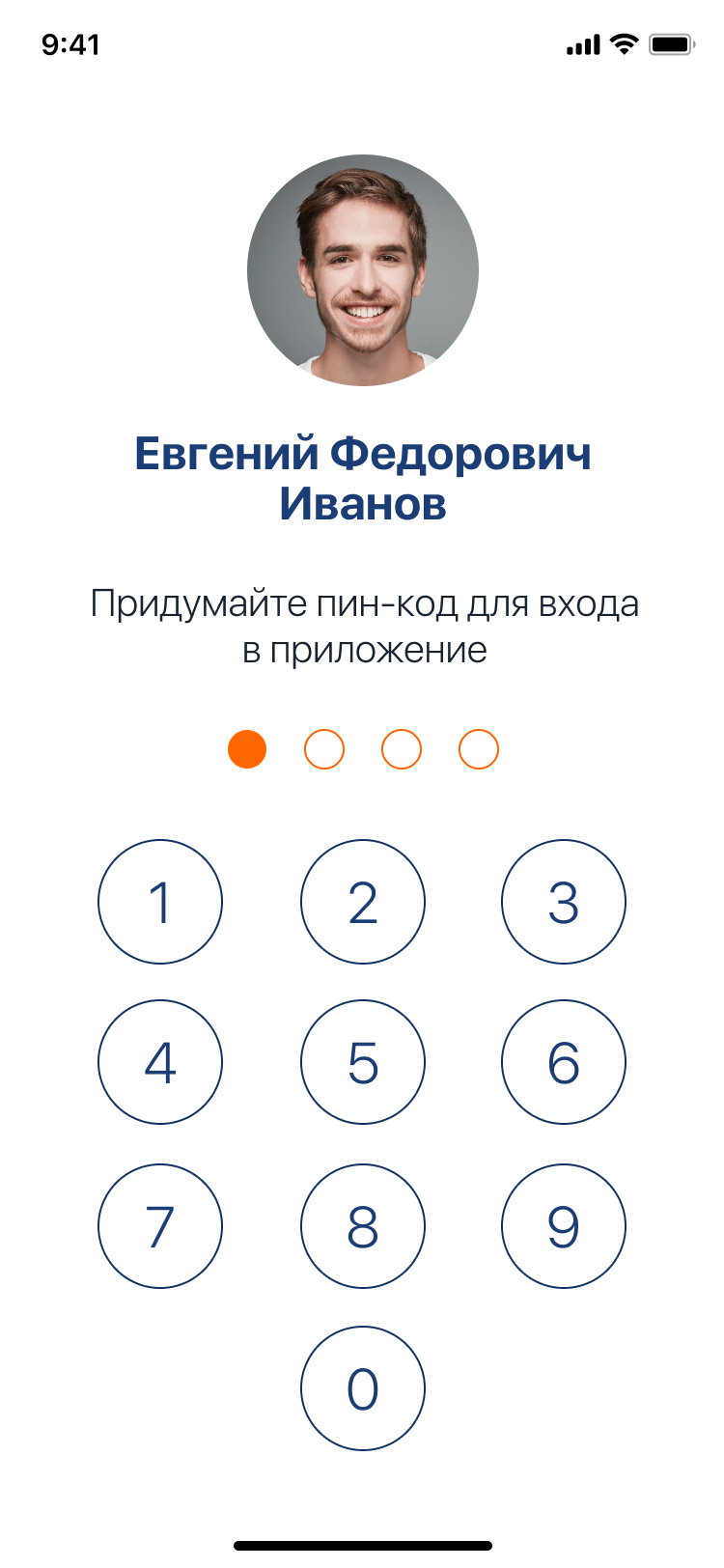

How to register in the application “My taxes” through the taxpayer’s personal account

It’s the simplest way to register through any device, even if the camera does not work on it, without scanning your passport and taking a photo. You need a INN (Taxpayer Identification Number) and a password to access the personal account of a taxpayer - natural person. This is the personal account that you usually use on the nalog.ru website to send income declarations, pay property taxes and apply for deductions.

Other ways to register

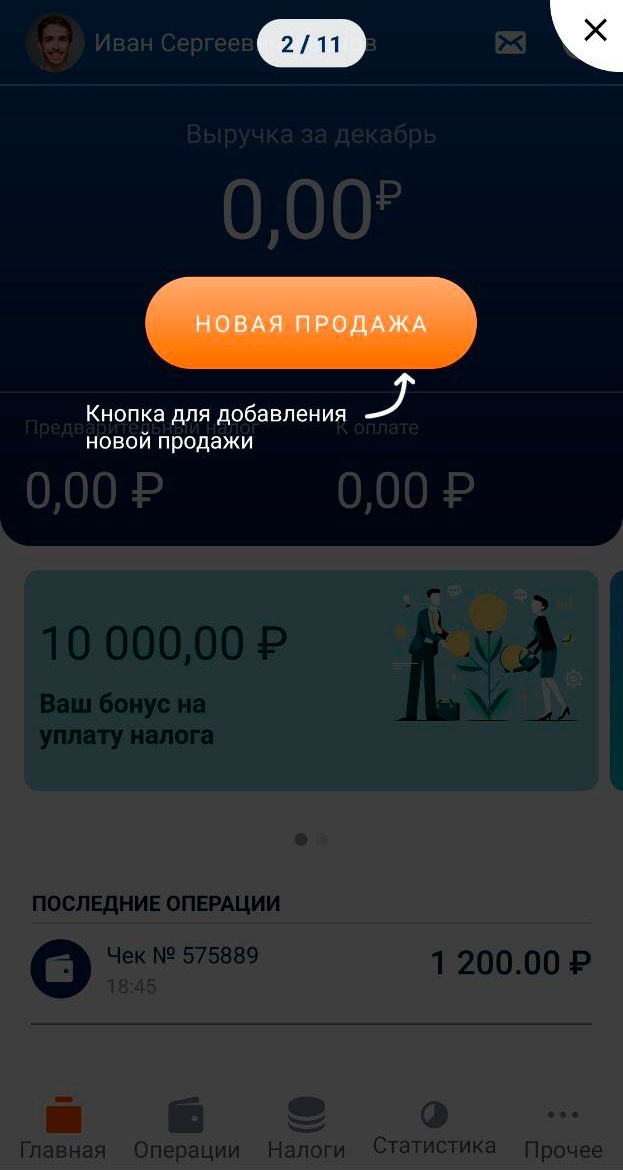

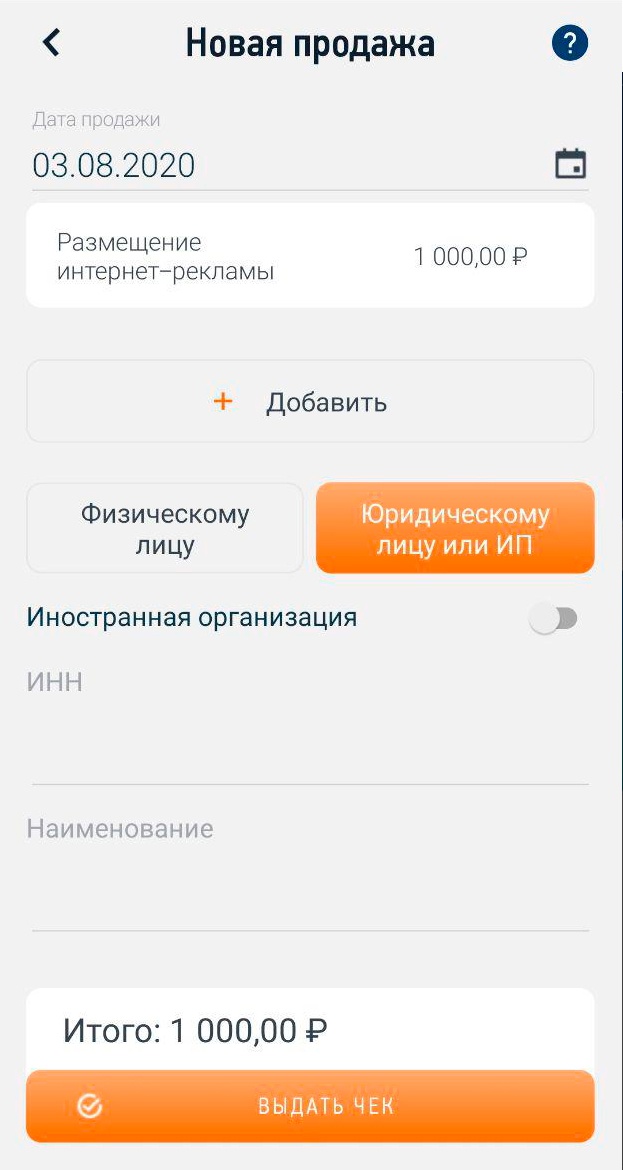

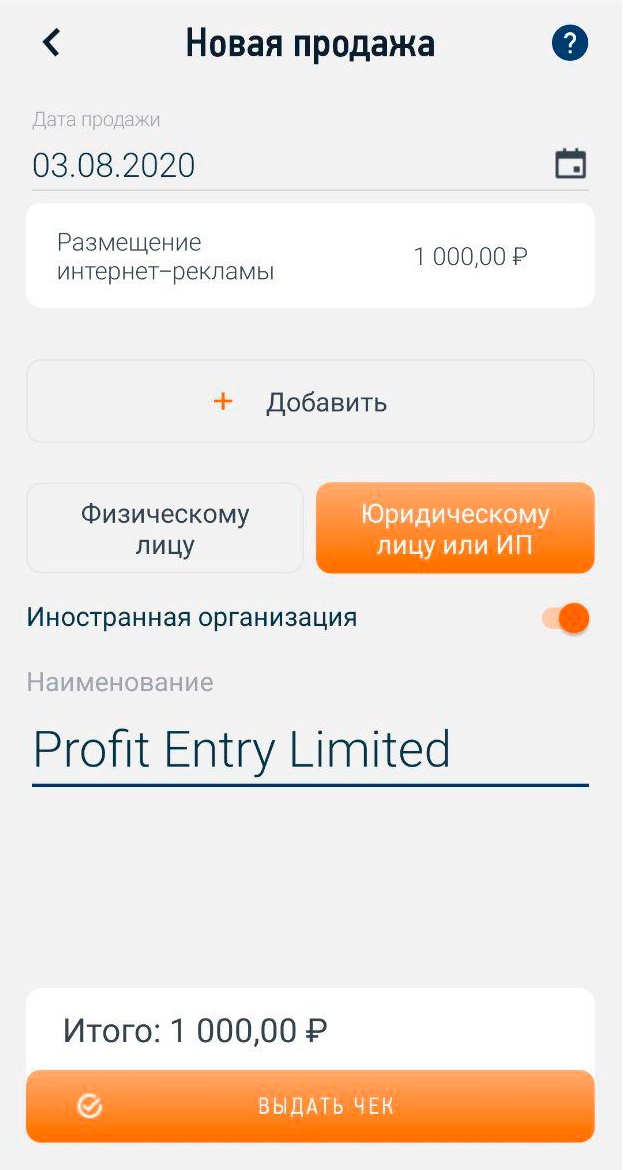

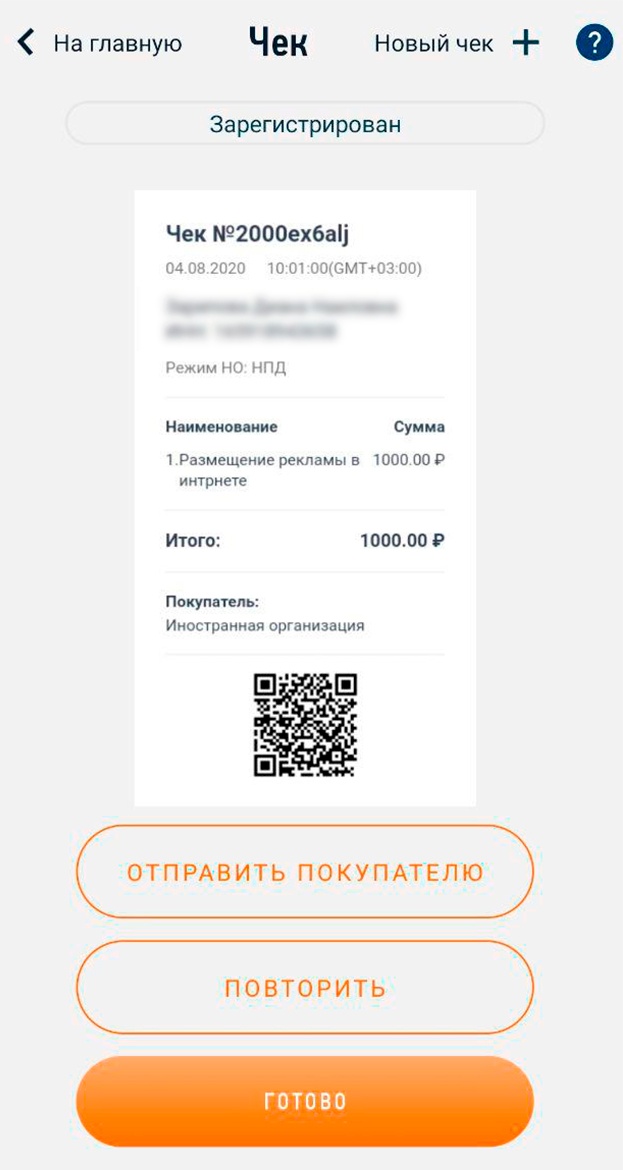

How to register earnings from ePN

Done! You have registered your income and can pay tax on it.